In brief

- Wrapped Bitcoin helps BTC holders get involved in the DeFi scene on Ethereum.

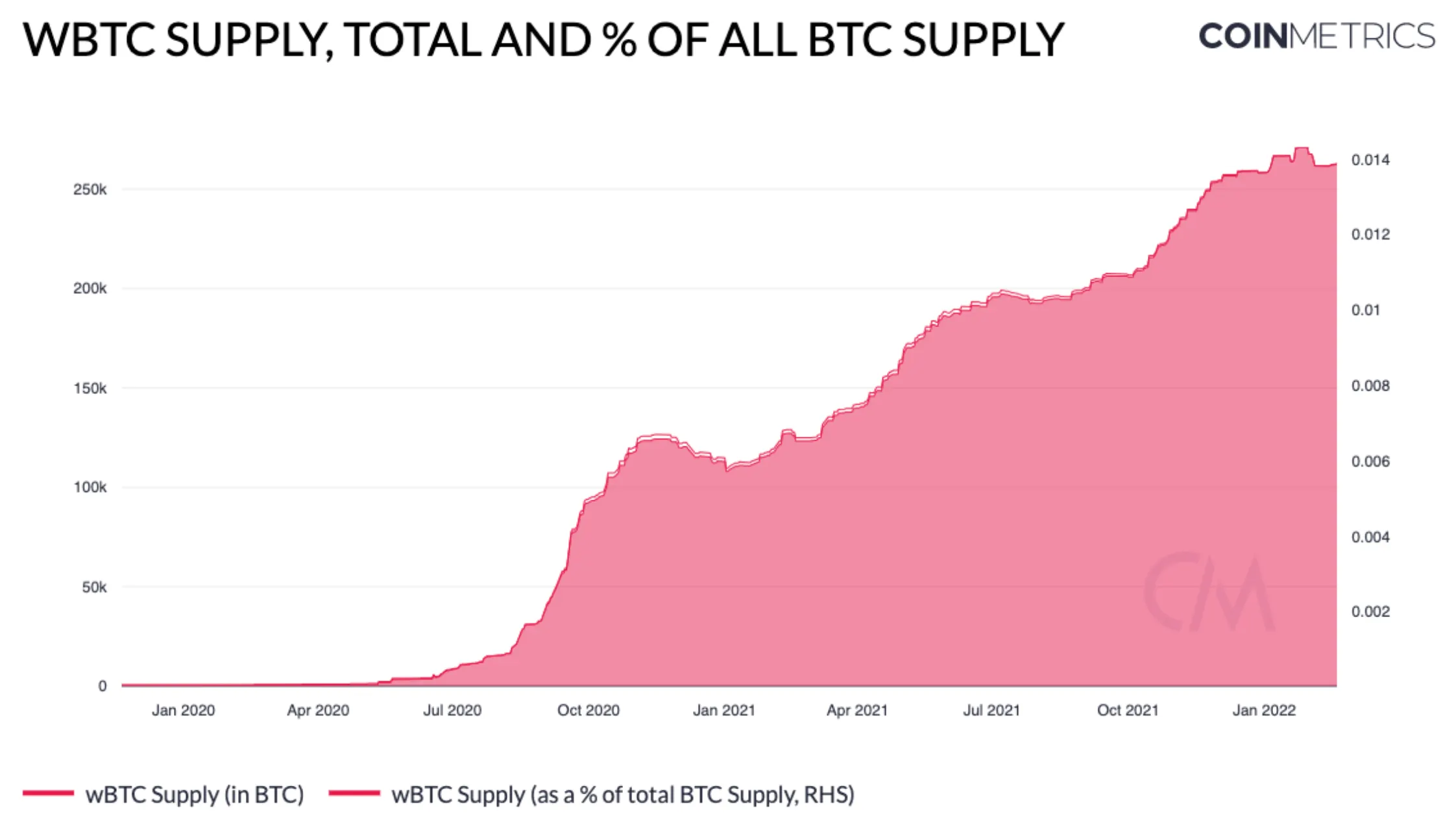

- The amount of WBTC on the Ethereum network has plateaued since December.

- This corresponds roughly with the crypto market downturn.

We do the research, you get the alpha!

Despite Wrapped Bitcoin's surging popularity in 2021, its supply growth has stagnated since December of last year, according to a report from crypto financial intelligence provider CoinMetrics this week.

Wrapped Bitcoin is an ERC-20 Ethereum token backed 1:1 by Bitcoin (BTC). All wBTC is redeemable for actual BTC held custodially in a multi-signature wallet controlled by BitGo. The asset is similar to dollar-pegged stablecoins, which allow holders to effectively transfer and utilize their fiat money on Ethereum rails.

This is beneficial to holders of the top cryptocurrency, as the native Bitcoin blockchain is not as versatile as Ethereum for enabling DeFi. Decentralized Finance, or DeFi, refers to blockchain applications that enable financial services such as lending and asset swaps without using third-party intermediaries.

By converting their holdings to Wrapped Bitcoin, crypto users can try to grow their holdings within various smart contract protocols while maintaining the ability to redeem their Bitcoin at any time.

Currently, about 1.4% of the total Bitcoin supply of nearly 19 million BTC is circulating on Ethereum through Wrapped Bitcoin. Of those 263,000-odd tokens, 66% are locked up in smart contracts, providing evidence that traders are using the asset on decentralized exchanges and lending protocols.

Among those protocols, Maker—the algorithmic lender behind DAI stablecoins—appears to be the most popular. Users presently have about 56,000 WBTC parked in the protocol, serving as collateral for DAI loans. Another 6,000 WBTC are providing liquidity to traders across five different Uniswap V3 pools.

Other WBTC are also being held on other chains, with over 20,000 locked in a contract that bridges Ethereum to Avalanche. However, mirroring the asset’s broader growth trajectory, WBTC stored at this bridge address have stopped increasing since 2022 began.

The amount of WBTC in circulation more than doubled from January to December of 2021 but has since stayed flat at approximately 260,000 units.

This reflects a similar trend across the Defi space. As displayed by DefiLlama, the total value locked in decentralized finance protocols has pulled back below $200 billion—down from over $251 billion on December 27.

The broader crypto market has also performed underwhelmingly. Bitcoin is down 20% year to date, and CoinMetrics noted that active Bitcoin and Ethereum addresses have dropped 8% since last week. According to blockchain analytics firm Glassnode, various macro headwinds show that Bitcoin may be in for a sustained bear market.